"Financial threats vary, from online fraud and banking Trojans that affect personal computers, tablets and smart phones, to attacks on financial organisations, ATMs and even merchants' terminals," Vitaly Kamluk, Kaspersky Lab's director of global research and analysis in the Asia Pacific, told a conference called Cyber Security Weekend for Asia Pacific Countries held recently in Indonesia.

"Analysing our statistics, we see that as the financial sector in Asia-Pacific countries is developing fast, cybercriminals are increasingly looking for ways they can profit from it.

"Since a lot of organisations and individuals often forget about security when adopting new technologies, we believe it is important to remind them about cyber-security principles that will help them stay safe."

The 2016 Consumer Security Risks Survey done by B2B International and Kaspersky Lab showed that 55.5 per cent of respondents in Viet Nam are worried about online banking fraud and 57 per cent said they often worry about their vulnerability when making financial transactions online.

More than 68 per cent stated they would use online payments more often if they had reliable protection for financial transactions.

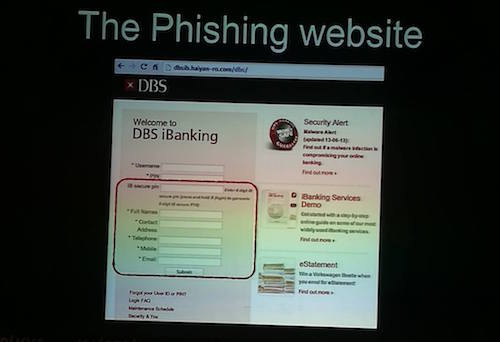

Banking Trojans remain one of the most dangerous online threats. They are often propagated via compromised or fraudulent websites and spam emails and, after infecting users, steal personal information such as bank account and card details and passwords.

According to Kaspersky Security Network data, Russia and Sri Lanka had the largest number of victims in the third quarter of this year and Viet Nam and India in the second.

"Spam, phishing and banking Trojans are among the most widespread financial threats," Kamluk said.

"So users should be attentive to fake web pages and unexpected e-mails asking to provide financial information, and secure their mobile devices if transactions are made from them.

"Organisations should also regularly check their IT infrastructure and especially computers from which financial transactions are made."